New York, May09, 2022(GLOBE NEWSWIRE) -- Reportlinker.com announces the release of the report "Global Managed Services Market Size, Share & Industry Trends Analysis Report By Enterprise Size, By Vertical, By Deployment Type, By Type, By Managed Information Service Type, By Regional Outlook and Forecast, 2021 - 2027" - https://www.reportlinker.com/p06273363/?utm_source=GNW

This term isn’t limited to IT because managed services can encompass anything from supply chain management to marketing strategy to call center operations.

Managed services assist firms in increasing operational efficiency and lowering operating costs while allowing them to concentrate more effectively on their core capabilities. Managed services help increase overall profitability and improve operational efficiency by ensuring optimal resource distribution and use. Businesses are finding it simpler to react to technology advances because of scalable infrastructure & flexible managed services models. Over the forecast period, all of these factors are expected to fuel the market growth.

To enhance commercial operations, managed services entail outsourcing managerial functions to a third party. Managed services have emerged as a result of the emergence of cloud-based technologies and their technical diffusion. Managed services help firms improve their operational efficiency and lower their operating costs. Over the projected period, the market is expected to rise due to the growing inclination for outsourcing management functions to cloud service providers & managed service providers.

Managed services might be beneficial to teams that don’t have the time, expertise, or experience to handle some business processes internally, or who choose to focus their efforts elsewhere. Using an expert to provide a service helps the staff to concentrate on innovation rather than mundane activities. Because the managed service provider is responsible for keeping the service available at all times, companies don’t have to worry about outages. A service level agreement (SLA) governs the delivery of the service and support, making it clear when to expect & what to expect it. An in-house staff is frequently juggling numerous duties, whereas an MSP may concentrate on mastering the delivery of a single service. This entails concentrating on the service’s health & security, as well as applying patches and upgrades as needed.

COVID-19 Impact

Businesses are putting a major emphasis on remote working as a result of the COVID-19 pandemic outbreak. There are many companies that are increasingly shifting to cloud services to ensure business continuity amid the coronavirus lockdowns implemented by various governments as part of their efforts to restrict the virus’ spread. The majority of businesses have already renewed their contracts with managed cloud service providers with the expectation of cloud migration becoming more widespread and, in some cases, getting traction. Moreover, as part of their attempts to stimulate digital transformation, businesses and organizations were putting a heavy emphasis on integrating the latest technologies, like augmented reality, and machine learning alongside their current IT infrastructure.

Market Growth Factors

Growing Organizational Acceptance of Bring Your Device (BYOD) trend

In today’s technology-driven company environment, Bring Your Device (BYOD) is one of the most important components of digital technology and productivity across all sectors. To boost efficiency in the workplace, the BYOD concept allows employees to access and control data via personal devices. Companies that encourage the use of BYOD can save up to USD 350 per year, per team member, according to a report issued by Cisco Systems, Inc. Employees’ work accountability and flexibility improve as a result of BYOD, resulting in increased productivity. As a result, enterprises are being advised to integrate BYOD solutions with current systems to build a workforce-friendly workplace. Because of the rising usage of BYOD, the number of intelligent devices in the workplace, like laptops, smartphones, tablets, and other gadgets, has expanded.

Rising adoption of cloud solutions and services

Cloud technology is used to create new customer engagement platforms as well as digital transformation platforms. An almost significant amount of businesses are working in a multi-cloud environment. But, most businesses find it difficult to implement a multi-cloud environment to improve consumer interaction due to a lack of skills and infrastructure. MSPs with DevOps competence and those who can offer consumption-based pricing models have a new opportunity. Various cloud-based solutions and services are gaining traction among enterprises due to its various features and advantages over traditional solutions.

Market Restraining Factors

Improved cost control

The cost of a business service is determined by an organization’s requirement for service criticality and availability. The MSP covers the regular costs of an IT department, like as training, equipment, and workers, and bills the employer on a monthly basis. This makes it easy to precisely predict spending each month when budgeting. The managed service can scale to accommodate such eventualities based on future needs and the speed with which the organization’s IT maturity grows. The most major benefit is that a company may decide how much to scale based on factors like financing and the CIO’s strategic vision. IT Service disruptions and unforeseen circumstances can also be avoided, reducing the danger of further losses.

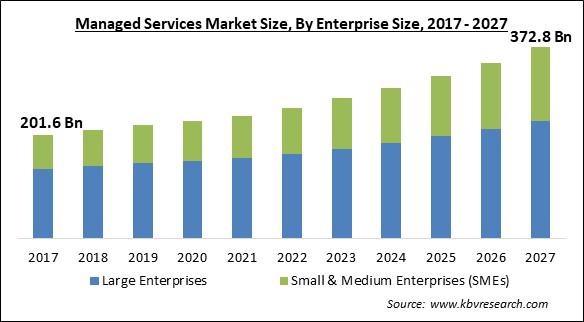

Enterprise Size Outlook

Based on Enterprise Size, the market is segmented into Large Enterprises and Small & Medium Enterprises (SMEs). The Small & Medium enterprise segment garnered a substantial revenue share in the managed services market in 2020. Increased government support for SMEs in the form of tax reliefs, loans, financial assistance, and social assistance, as well as other digital SMEs campaigns around the world, is predicted to boost the segment’s growth. SMEs’ increased adoption of business operations automation and advanced information technology infrastructure is also predicted to promote segment expansion during the forecast period. Cloud computing, virtualization, and automation have come together to provide a delivery platform that allows small businesses to receive managed services at a lower cost and with greater efficiency.

Vertical Outlook

Based on Vertical, the market is segmented into BFSI, IT & Telecom, Healthcare, Retail & eCommerce, Government & Defense, Media & Entertainment, Manufacturing and Others. The BFSI segment acquired the highest revenue share in the managed services market in 2020. Managed services are being used by financial institutions to handle a variety of concerns, including keeping up with technology improvements, market & regulatory changes, and a looming shortage of staff with experience in cutting-edge technologies, among others. In the big scheme of things, the managed services model may help companies manage their processes and operations while also increasing product quality and operational efficiency. In addition, managed services are growing in popularity as companies seek a more strategic approach to successfully administer, organize, and safeguard their operations.

Deployment Type Outlook

Based on Deployment Type, the market is segmented into On-premise and Hosted. The Hosted segment procured a substantial revenue share in the managed services market in 2020. It is due to technical advancements and other perks like cost-effectiveness and low operational costs. The key benefit of this deployment technique is that businesses using hosted services do not have to upgrade them regularly. The system software & services can be upgraded as needed by the service providers. Manufacturers are likely to embrace a hosted managed services (HMS)-based deployment model to reclaim control of escalating IT and licensing costs while freeing up IT staff to focus on new business instead of upgrades and system updates.

Type Outlook

Based on Type, the market is segmented into Managed Data Center & IT Infrastructure, Managed Network & Communication Services, Managed Mobility Services, Managed Information Services, Managed Security Services, and Others. Based on Managed Information Service Type, the market is segmented into Business Process Outsourcing (BPO), Business Support Systems, Project & Portfolio Management and Others. The Managed data centre & IT infrastructure segment acquired the highest revenue share in the managed services market in 2020. Due to the continuing integration of cutting-edge technology into new and existing corporate infrastructures, the managed data centre market is likely to increase. In a hybrid IT architecture, managed data centre services could help optimize corporate operations by increasing business automation and enhancing business management.

Regional Outlook

Based on Regions, the market is segmented into North America, Europe, Asia Pacific, and Latin America, Middle East & Africa. Asia Pacific garnered a significant revenue share in the managed services market in 2020. Several companies in the Asia Pacific region are expected to contribute significantly to market growth over the projected period by employing cloud-based solutions and increasing data security investments. Moreover, the market expansion is likely to be aided by increased spending as a result of firms’ acceptance of cutting-edge technologies like as advanced technology cloud-based technology for company development.

The major strategies followed by the market participants are Partnerships. Based on the Analysis presented in the Cardinal matrix; AT&T, Inc. and Verizon Communications, Inc. are the forerunners in the Managed Services Market. Companies such as Cisco Systems, Inc., IBM Corporation, and Accenture PLC are some of the key innovators in the Market.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include IBM Corporation, Atos Group, Accenture PLC, Fujitsu Limited, Cisco Systems, Inc., DXC Technology Company, Tata Consultancy Services Ltd., Rackspace Technology, Inc., AT&T, Inc., and Verizon Communications, Inc.

Recent Strategies Deployed in Managed Services Market

Partnerships, Collaborations and Agreements

Mar-2022: Accenture came into a partnership with Vodafone, a British multinational telecommunications company. Following this partnership, the companies would provide managed security services to SMEs across Germany. Moreover, these services include Vulnerability Management, Breach Response, Cyber Exposure Diagnostic, Penetration Testing, and Forensics, etc.

Feb-2022: IBM collaborated with SAP, a German multinational software corporation. Through this collaboration, the companies aimed to encourage customers to adopt a hybrid cloud method and migrate mission-critical workloads from SAP solutions to the cloud for non-regulated and regulated industries.

Feb-2022: Verizon teamed up with VMware, an American cloud computing and virtualization technology company. Under this collaboration, Verizon would integrate VMware’s expertise in virtualization and cloud computing into Verizon’s Managed SD-WAN Service portfolio in order to complement Verizon’s vision of accelerating partner ecosystem in providing managed SD-WAN services. In addition, the new service is named VMware managed service solution.

Jan-2022: Rackspace entered into a partnership with BT, a British multinational telecommunications holding company. Through this partnership, Rackspace would integrate the network and security capabilities of BT with Rackspace’s excellence in cloud management, analytics, automation, and AI tools in order to offer an enhanced customer experience.

Nov-2021: Accenture entered into a partnership with Icertis, a software company. Following this partnership, Accenture would integrate Icertis’s best-in-class contract intelligence technology with its digital transformation capabilities in order to help industry-wide customers to get informed insights into their contracts, and manage the risk and efficiency of their contracting process.

Oct-2021: IBM teamed up with Apptio, a leading vendor of cloud-based Technology Business Management SaaS applications. Through this collaboration, the companies would help customers in enhancing hybrid cloud technology decision-making and propel the adoption of Red Hat’s OpenShift and open hybrid cloud approach of IBM by providing transparency along with migration and optimization capabilities for Red Hat OpenShift and IBM Cloud.

Oct-2021: Cisco extended its partnership with Tata Communications, an Indian telecommunications company. Following this extended partnership, the companies would offer a set of cutting-edge Wi-Fi 6 technology and SD-WAN-based cloud-managed Wi-Fi services to several industries.

Oct-2021: Verizon joined hands with Fortinet, an American multinational corporation. This collaboration aimed to integrate Fortinet Secure SD-WAN expertise into the portfolio of Verizon Software-Defined Secure Branch in order to offer in-a-box solutions to businesses. Moreover, the new solution is a converged security and networking solution intending to connect and secure remote and hybrid workforces.

Feb-2021: Verizon extended its partnership with Cisco, an American multinational technology. With this partnership expansion, Verizon would introduce three new SD-WAN managed services offerings in order to avail new capabilities and solutions along with an innovative management and policy administration approach to businesses.

Jan-2021: IBM partnered with Red hat and Telefonica. Following this partnership, Telefonica would introduce Telefonica’s hybrid IT-enabling Cloud Garden environment by leveraging IBM and Red Hat’s expertise in the cloud. In addition, IBM and Red hat would help Telefonica in accelerating the adoption of hybrid cloud in its customers.

Nov-2020: Cisco partnered with Wipro, an IT services provider. With this partnership, With this partnership, the companies would offer managed software-defined wide area network, or SD-WAN, transformation services enabled by global Secure SD-WAN managed services partner of Cisco, to Olympus.

Acquisitions and Mergers

Dec-2021: Accenture took over Headspring, a custom software engineering and consultancy firm. With this acquisition, the company aimed to strengthen its Cloud First business.

Dec-2021: Atos acquired Cloudreach, a leader in multi-cloud services. Through this acquisition, the company aimed to integrate consulting, transforming, and building digital solutions of Cloudreach with its hybrid and multi-cloud platforms.

Nov-2021: Accenture completed its acquisition of ClearEdge Partners, procurement spends Management Company. Through this acquisition, the company aimed to help its customers in optimizing the management of their digital transformation spends

Jun-2021: Accenture took over Sentor, a provider of cyber defense and managed security services. Following this acquisition, the company would increase its focus toward helping its clients to comply with the challenging cybersecurity environment.

Apr-2021: Fujitsu acquired Versor, a data analytics specialist management consultancy. With this acquisition, the company aimed to fulfill the rising demand for advanced data science consulting services. Moreover, this acquisition would complement the company’s strategy of strengthening its prevalence across the Australian market.

Oct-2020: Atos took over Paladion, a Managed Security Services. Following this acquisition, Atos would incorporate Paladion’s major Managed Detection & Response capabilities into its portfolio. Moreover, the company aimed to expand its global reach for cybersecurity and response monitoring by adding 4 Security Operations Centers in India, middle-East, and the US.

Product Launches and Product Expansions

Dec-2021: IBM rolled out IBM Z and Cloud Modernization Center. With this launch, the company would encourage customers to boost the modernization of their data, applications, and processes in an open hybrid cloud environment.

Dec-2021: Atos rolled out new Managed Detection and Response cybersecurity service. Through this acquisition, the company would help the media and entertainment industry in addressing piracy in content and media content along with preventing targeted cyber threats for organizations.

Oct-2021: AT&T introduced advanced and all-inclusive managed security capabilities for 5G network installation. The new service would offer capabilities for the prevention of advanced attacks, threat visibility, and security policy enforcement for 5G-enabled IT, OT, and IoT in order to support customers to scale and design security services with increased simplicity and reduced risk.

Mar-2021: IBM introduced new and improved services. The new product would integrate cloud-native, third-party, and IBM technologies to assist enterprises in managing their cloud security policies, strategy, and controls in hybrid cloud environments.

Mar-2021: AT&T collaborated with Fortinet, an American multinational corporation. Through this collaboration, AT&T aimed to expand its Managed Security Services portfolio with the addition of Fortinet’s expertise in managed SASE solutions in order to offer Secure Access Service Edge to enterprises.

Dec-2020: Verizon released IoT Managed Services, a new range of services. The new product line aimed to support businesses in managing the intricacies of preparing, maintaining, and deploying, an IoT solution for clients with a lack of staff, knowledge, resources, and time.

Nov-2019: Cisco introduced three new services into its managed services portfolio. Through this launch, the company aimed to support its partners in capitalizing over the managed services market as well as unlock key technology transitions for customers. Moreover, the new services are named Secure SD-WAN, Unified Communications Manager Cloud, and Managed Detection and Response.

Scope of the Study

Market Segments covered in the Report:

By Enterprise Size

• Large Enterprises

• Small & Medium Enterprises (SMEs)

By Vertical

• BFSI

• IT & Telecom

• Healthcare

• Retail & eCommerce

• Government & Defense

• Media & Entertainment

• Manufacturing

• Others

By Deployment Type

• On-premise

• Hosted

By Type

• Managed Data Center & IT Infrastructure

• Managed Network & Communication Services

• Managed Mobility Services

• Managed Information Services

o Business Process Outsourcing (BPO)

o Business Support Systems

o Project & Portfolio Management

o Others

• Managed Security Services

• Others

By Geography

• North America

o US

o Canada

o Mexico

o Rest of North America

• Europe

o Germany

o UK

o France

o Russia

o Spain

o Italy

o Rest of Europe

• Asia Pacific

o China

o Japan

o India

o South Korea

o Singapore

o Malaysia

o Rest of Asia Pacific

• LAMEA

o Brazil

o Argentina

o UAE

o Saudi Arabia

o South Africa

o Nigeria

o Rest of LAMEA

Companies Profiled

• IBM Corporation

• Atos Group

• Accenture PLC

• Fujitsu Limited

• Cisco Systems, Inc.

• DXC Technology Company

• Tata Consultancy Services Ltd.

• Rackspace Technology, Inc.

• AT&T, Inc.

• Verizon Communications, Inc.

Unique Offerings

• Exhaustive coverage

• Highest number of market tables and figures

• Subscription based model available

• Guaranteed best price

• Assured post sales research support with 10% customization free

Read the full report: https://www.reportlinker.com/p06273363/?utm_source=GNW

About Reportlinker

ReportLinker is an award-winning market research solution. Reportlinker finds and organizes the latest industry data so you get all the market research you need - instantly, in one place.

__________________________