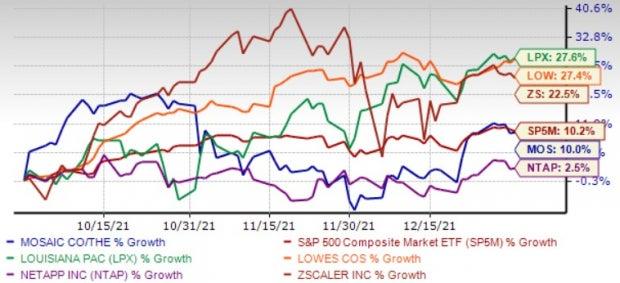

The Business Services sector, despite the coronavirus-induced market uncertainty, has been steadily gathering steam on the back of gradual resumption of business activities, increased adoption and success of the work-from-home model, rise in demand for risk mitigation and consulting services, and expertise in improving operational efficiency and reducing costs. Providers of essential and non-deferrable services, such as waste removal and building maintenance, remained resilient to the pandemic-induced disruptions.

Owing to its widely diversified nature, the sector seeks to benefit from the growth of the overall economy, which is expected to strengthen further on the success of the ongoing mass vaccination program, continued government response in the form of pandemic-relief packages, expanded unemployment benefits and relaxation of restrictions.

While Omicron and Delta variant cases have raised concerns lately, manufacturing and service strength has acted as a tailwind for the sector, which is a major beneficiary of the broader economy. Notably, the Institute for Supply Management has measured that Manufacturing PMI and Services PMI have clocked the 19th consecutive month of expansion in December. The December Manufacturing PMI touched 58.7%. The December Services PMI registered 62%, slightly lower than the all-time high of 69.1% reported in November. 15 manufacturing industries and 16 services industries have reported growth in December.

Meanwhile, a steady recovery is evident from the latest fourth-quarter 2021 GDP number, which, according to the estimate released by the Bureau of Economic Analysis, increased at an annual rate of 6.9%, higher than 2.3% growth witnessed in the third quarter of 2021.

Stocks Poised to Beat

We have narrowed down the list of choices by looking at stocks that have the combination of a favorable Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) and a positive Earnings ESP. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Earnings ESP is our proprietary methodology for determining stocks that have the best chance to surprise with their next earnings announcement. It is the percentage difference between the Most Accurate Estimate and the Zacks Consensus Estimate.

Our research shows that for stocks with this combination, the chance of a positive earnings surprise is as high as 70%.

Let’s have a look at the three picks set to report fourth-quarter 2021 results.

Genpact Limited G: This Bermuda-based company provides business process outsourcing and information technology (IT) services in North and Latin America, India, rest of Asia and Europe. The company continues to enjoy a competitive position in the BPO services market based on domain expertise in business analytics, digital and consulting. Buyouts boost customer base and drive top-line growth. Artificial Intelligence offers ample growth opportunities. Genpact is benefiting from its strong clientele across the world. Consistency in dividend payments and share repurchases boost investor confidence and positively impact earnings per share.

Genpact has an Earnings ESP of +2.86% and currently carries a Zacks Rank #2. The company will release fourth-quarter earnings numbers on Feb 11, before the market opens.

Genpact Limited Price and EPS Surprise

Genpact Limited price-eps-surprise | Genpact Limited Quote

The Zacks Consensus Estimate for Genpact’s to-be-reported quarter’s EPS has moved up 3.3% in the past 90 days, suggesting a year-over-year increase of 3.9%. Further, the company has a trailing four-quarter earnings surprise of 15.1%, on average.

S&P Global Inc. SPGI: This New-York based company provides ratings, benchmarks, analytics and data to capital and commodity markets worldwide. The company remains well poised to gain from the growing demand for business information services. Buyouts have helped it innovate, increase differentiated content and develop new products. Effective management execution has helped it generate solid cash flow, which is utilized for growth initiatives. Dividend payments and share repurchases boost investors' confidence and positively impact earnings per share. While solid increase in revenues ghas been aiding the company’s bottom-line growth, the top line is backed by strength across each segment.

S&P Global has an Earnings ESP of +1.33% and currently carries a Zacks Rank #3. The company will release fourth-quarter earnings numbers on Feb 8, before the market opens.

S&P Global Inc. Price and EPS Surprise

S&P Global Inc. price-eps-surprise | S&P Global Inc. Quote

The Zacks Consensus Estimate for S&P Global’s to-be-reported quarter’s EPS has moved up 2.3% in the past 90 days, suggesting a year-over-year increase of 15.5%. Further, the company has a trailing four-quarter earnings surprise of 9.1%, on average.

Aptiv PLC APTV: This company designs, manufacturers, and sells vehicle components worldwide. APTV is well positioned to leverage on growing electrification, connectivity and autonomy trends in the rapidly evolving automotive sector. The company has ramped up investments in advanced technology and collaborations to make the most of the opportunities offered by the automotive sector. Acquisitions and collaborations help Aptiv capitalize on developing automotive markets.

Aptiv has an Earnings ESP of +6.39% and currently carries a Zacks Rank #3. The company will release fourth-quarter earnings numbers on Feb 3, before the market opens. Further, the company has a trailing four-quarter earnings surprise of 8.8%, on average. Aptiv PLC Price and EPS Surprise

Aptiv PLC Price and EPS Surprise

Aptiv PLC price-eps-surprise | Aptiv PLC Quote

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Infrastructure Stock Boom to Sweep America

A massive push to rebuild the crumbling U.S. infrastructure will soon be underway. It’s bipartisan, urgent, and inevitable. Trillions will be spent. Fortunes will be made.

The only question is “Will you get into the right stocks early when their growth potential is greatest?”

Zacks has released a Special Report to help you do just that, and today it’s free. Discover 7 special companies that look to gain the most from construction and repair to roads, bridges, and buildings, plus cargo hauling and energy transformation on an almost unimaginable scale.

Download FREE: How to Profit from Trillions on Spending for Infrastructure >> Click to get this free report Genpact Limited (G): Free Stock Analysis Report S&P Global Inc. (SPGI): Free Stock Analysis Report Aptiv PLC (APTV): Free Stock Analysis Report To read this article on Zacks.com click here. Zacks Investment ResearchThe views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.