by Paul Moomjean

paulmoomjean@yahoo.com

For the past decade plus, I’ve written about topics with a basic understanding of the subject matter. Whether it be elections, social media or cultural issues, I’ve always had some formidable grasp of the topic. There is an origin, a clear conflict, and a potential resolution. Say whatever you want about unemployment or student loan debt, there are clear pathways to figure out how it occurs and how our capitalistic system can work to fix it. We may not agree, but we can agree it exists.

You cannot say the same for bitcoin and cryptocurrency. For about a decade now Wall Street and even Matt Damon have been pushing the idea of magical money that people own in a way that has some logistical boundaries, but in the end turns the brain to mush while trying to comprehend it. And considering that this is a potential future for our economy, there’s a sense that if the Biden administration and world governments don’t get their heads around this, we will find a small minority of billionaires controlling Wall Street — but in the way about which conspiracy theorists have been crying into the wilderness for decades now.

A basic definition from Investopedia reads reasonable, if ambiguous: “A cryptocurrency is a digital or virtual currency that is secured by cryptography, which makes it nearly impossible to counterfeit or double-spend. Many cryptocurrencies are decentralized networks based on blockchain technology — a distributed ledger enforced by a disparate network of computers. A defining feature of cryptocurrencies is that they are generally not issued by any central authority, rendering them theoretically immune to government interference or manipulation.”

Yet, why is it so expensive to trade? Who is regulating it? What in the heck can I buy with it? While there appear to be some definitive definitions, when I read about its recent Wall Street crash, my head starts spinning.

MarketWatch explains what happened last week in such convoluted terms, I’m just going to leave it here and hope you have a Ph.D. in linguistics or nuclear physics:

“It has been a bloodbath week, as some called it, for the crypto market. Stablecoin USDTerra, or UST USTUSD, -3.48%, once among the top 10 largest cryptocurrency by market cap, lost its 1 to 1 peg against the U.S. dollar, falling to as low as 6 cents on Friday, according to CoinDesk data. LUNA LUNAUSD, 0.00%, another cryptocurrency backing UST, fell nearly to zero from over $80 in early May, with its market capitalization shrinking by more than $40 billion from early April.” (“How a bitcoin market ‘in extreme fear’ compares with the past, and what to expect next,” by Frances Yue, May 14, 2022.)

All of the above words are in English, but how in the world does something drop $40 billion and not completely destroy the economy? Well, it’s because it’s not real.

One time in Las Vegas I lost $9,000 at a blackjack table. In reality, I lost nothing. I had started with $1,000 and earned nine times my investment, but after getting wasted and developing a crush on my card dealer, I stayed too long and lost what was never really mine. This is the story of cryptocurrency.

MarketWatch went on to claim, “It marks ‘the largest wealth destruction event in the short history of the crypto markets,’ since bitcoin was created in 2009, crypto trading firm QCP Capital wrote in a Friday note . . . More than $400 billion has been wiped out from the crypto market during the past seven days, according to CoinGecko.”

The cryptocurrency machine is fighting back on its most recent collapse.

“It’s a pattern. Back when we look at what happened in 2014, the crash happened and there’s a big panic. People say, oh, crypto is dead. It’s not coming back. But of course, it has come back,” Mike Belshe, founder and chief executive at crypto infrastructure provider BitGo, told MarketWatch.

What needs to be understood is that the real fear isn’t that billions of fake dollars were lost. That’s like being scared for Hollywood when a wannabe star like Tara Reid never makes it. No real loss. What needs to be regulated is this reliance on a fake currency as a way to build the world’s economy.

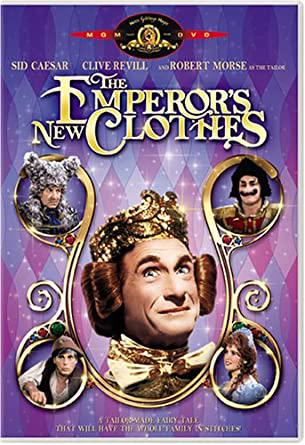

With real life billionaires like Elon Musk owning massive shares of this make-believe money, the concern is that if it becomes legitimized, people around the world will start to spend money they don’t have in an attempt to create wealth that isn’t real. America was built on tangible items like the automobile. We don’t need the Emperor’s New Currency to be the wave of the future.