The

full 7,000+ word teardown

originally appeared on the

CB Insights research portal

.

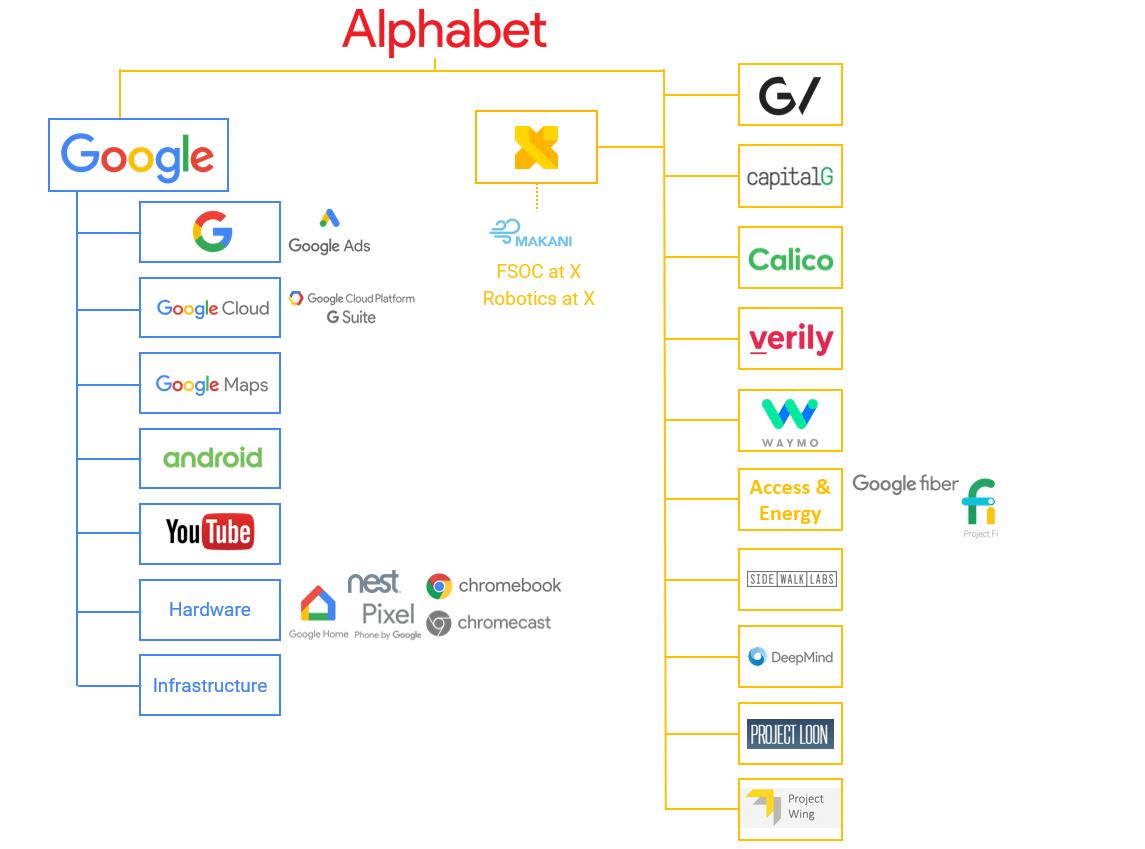

This piece is the second in a 3-part series, and will explore Google's acquisition activity.

Part 1

featured a short introduction and background.

Google has traditionally ranked among the most acquisitive tech corporations, but the pace of its acquisitions slowed both leading up to and following the reorganization under the Alphabet umbrella.

Since 2001, the company has made nearly 200 acquisitions to bring on external talent and expand into new sectors, and in the process coined another tech adage in the form of Larry Page’s

“toothbrush test”

for whether an M&A target is worthy. (The target must develop a product that its customers consider indispensable on a daily basis.)

Our

acquisition tracker

includes each acquisition in the steady stream of Mountain View purchases. Alphabet has now acquired 13 companies year-to-date (10/10/16), with three acquisitions last month alone, including the $625M purchase of publicly traded enterprise cloud company

Apigee

. We used the CB Insights Acquirer Analytics tool to track the company’s M&A activity since 2010:

Google has remained a dominant force in tech M&A for much of the decade; activity peaked in 2014 as Google acquired over a dozen companies in the second quarter, ranking

far ahead of other tech giants

in acquisitions in that year. However, the company’s acquisition pace slowed considerably leading up to the Alphabet restructuring, and decreased markedly in the first half of 2016. This most recent quarter has seen a resurgence in activity, though it remains to be seen whether that will be a temporary blip, or a signal that Mountain View feels comfortable maintaining the renewed pace under Alphabet.

To date in Q4’16, Alphabet has only acquired

Famebit

, a platform that helps brands connect with video creators on YouTube.

Aside from a new focus on fiscal restraint, lackluster results from marquee acquisitions earlier in the decade may have given the company pause. The company’s rapid acquisition of at least 7 unique robotics companies—

Schaft

,

Industrial Perception

,

Meka Robotics

,

Redwood Robotics

,

Bot & Dolly

,

Holomni

, and most notably

Boston Dynamics

—triggered a peak in hype in 2014 (as shown by our Trends tool, below), but those companies never coalesced into a productive robotics unit.

Former Android head Andy Rubin led the robotics push, but Rubin departed the company in October 2014 to found hardware startup incubator Playground Global. The loss of the visionary figure likely held back his robotics division, named Replicant, from ever truly becoming a cohesive unit under either Google or Alphabet.

Instead, the Replicant companies came directly into management’s crosshairs following Alphabet’s creation, as the new company took a hard look at the revenue-generating potential of its various units. Though subsidiaries like Boston Dynamics were a hit on YouTube, the long road to commercialization led to the unit being

shopped for sale

in early 2015 (with a buyer still yet to emerge).

Most recently, Google’s significant 2014 commitments to the smart home with

Revolv

,

Dropcam

($555M), and

Nest

($3.2B, its largest startup purchase to date) have also been troubled by allegations of mismanagement and employee attrition. The tensions at Nest came to a public head with the departure of Nest co-founder and CEO Tony Fadell in June. The run-up to Fadell’s resignation saw repeated mentions of friction among smart home leadership, most notably a Medium post from

Dropcam founder Greg Duffy

(whose Dropcam team was folded into the Nest smart home division):

The troubles at Nest can be read as a failure of the old structure to properly discipline its various operating units and harmonize goals and culture across the Googleplex, even as the company expanded into new markets and product lines.

In fact, the Nest division (now a standalone Alphabet unit) was sidelined from the company’s new smart home hardware effort, Google Home, just launched at an October 4, 2016 event. As Alphabet’s de facto smart home unit, Nest might have seemed the natural candidate to build a challenger to Amazon’s successful Echo device. However, the clear threat to the company’s principal search business coming from Amazon’s device, and the increasing competition with Amazon as a whole, may have led Google to conclude

it had to develop Home within the core of the company, with direct supervision from Google’s executive suite

.

Moreove

r, such a product demanded close integration with Google’s core search and virtual assistant services. Nest, at arm’s length from core Google, would have had more trouble crossing interdepartmental borders and winning consensus to achieve this.The new unitized Alphabet structure could be conducive to more successful M&A and integration of disparate businesses. The various divisions under Alphabet will be able to lobby for acquisitions aligned with their strategic interests and roadmaps, but also face a clearer organizational structure leading to Alphabet’s executive suite, as well as a new mandate for less speculative bets.

Though its robotics and smart home investments have become cautionary tales, Google’s acquisitions in many other fields have produced more unambiguously positive results.

DeepMind

, another 2014 purchase valued somewhere between $500M and $600M, has cemented Google’s reputation in AI research with its high-profile AlphaGo and

WaveNet projects

and its tech has already been applied in areas from Google’s data centers to its translation tools.

Beyond the smart home, Mountain View’s intensifying competition with Amazon has also led to a spate of acquisitions in cloud and enterprise services, as well as a different strategic approach. Google proper has made bolstering its cloud platform a top priority, since it has traditionally lagged Amazon’s AWS and Microsoft’s Azure in this area (despite recently winning strategic cloud clients, including

Apple and Spotify

in early 2016).

Google is also relying heavily upon acquisitions in this area to supplement internal R&D and bolt value-added services on top of its platform. In particular, CEO Sundar Pichai has said that the company is aiming to compete with

robust, developer-friendly services

, as opposed to providing sheer scale. Our acquirer analytics data highlights this effort:

A prime example is Google’s September 2016 acquisition of

Api.ai

, a startup helping developers build conversational intelligence interfaces. This meshes nicely with artificial intelligence, the other pillar of Google’s differentiation strategy (discussed in greater detail within the

industries section

).

Its other purchases in this area range from

Stackdriver

,

Appurify

,

Firebase

, and

Zync Render

in 2014 to its acquisitions of Apigee and

Orbitera

within the past two months. Indeed, over half of its 2016 acquisitions to date involve enterprise applications or B2B cloud services. Many of these have come after Recode’s March report that Google

was most actively hunting

for targets in the enterprise cloud arena.

With its cloud push, Google has thus far focused on multiple targets serving the mid-market and aimed at adding a variety of enterprise capabilities,

as opposed to a multi-billion blockbuster acquisition

in the vein of Nest. Its $100M purchase of billing service Orbitera is emblematic of this catch-up strategy, as well as its support of a

flexible, “multi-cloud” world

, where large enterprises increasingly rely on multiple vendors.

It’s also worth noting that compared to leading-indicator bets in promising but unproven sectors (e.g., autonomous cars and robotics), Alphabet’s string of cloud and enterprise acquisitions come in a mature sector with obvious financial opportunity.

Alphabet’s June acquisition of

Webpass

also comes from the mature field of telecommunications. Alphabet’s Access & Energy unit, which encompasses Fiber, has already announced plans to leverage Webpass’s wireless technology to reduce the capital expenses and deployment times associated with Fiber’s costly expansion. In this context, Webpass appears to be another immediate-impact acquisition to reduce losses and drive profitability.

Admittedly, it has been a short year since the birth of Alphabet, but the data thus far reflects the new organization’s attempt to balance moonshots with fiscal responsibility and clear paths to revenue.

Part 3

explores investment activity across the various Alphabet investment arms.

For even more on Alphabet, see our

full 7,000+ strategy teardown

(first published on the

CB Insights research portal

), which covers additional topics including:

Investments across Google, GV, and Google Capital

Patent data analysis

Alphabet initiatives in AI, cloud & enterprise, hardware, and more

For more data on corporate investment, acquisition, and research activity, check out the CB Insights

tech market intelligence platform

for free.